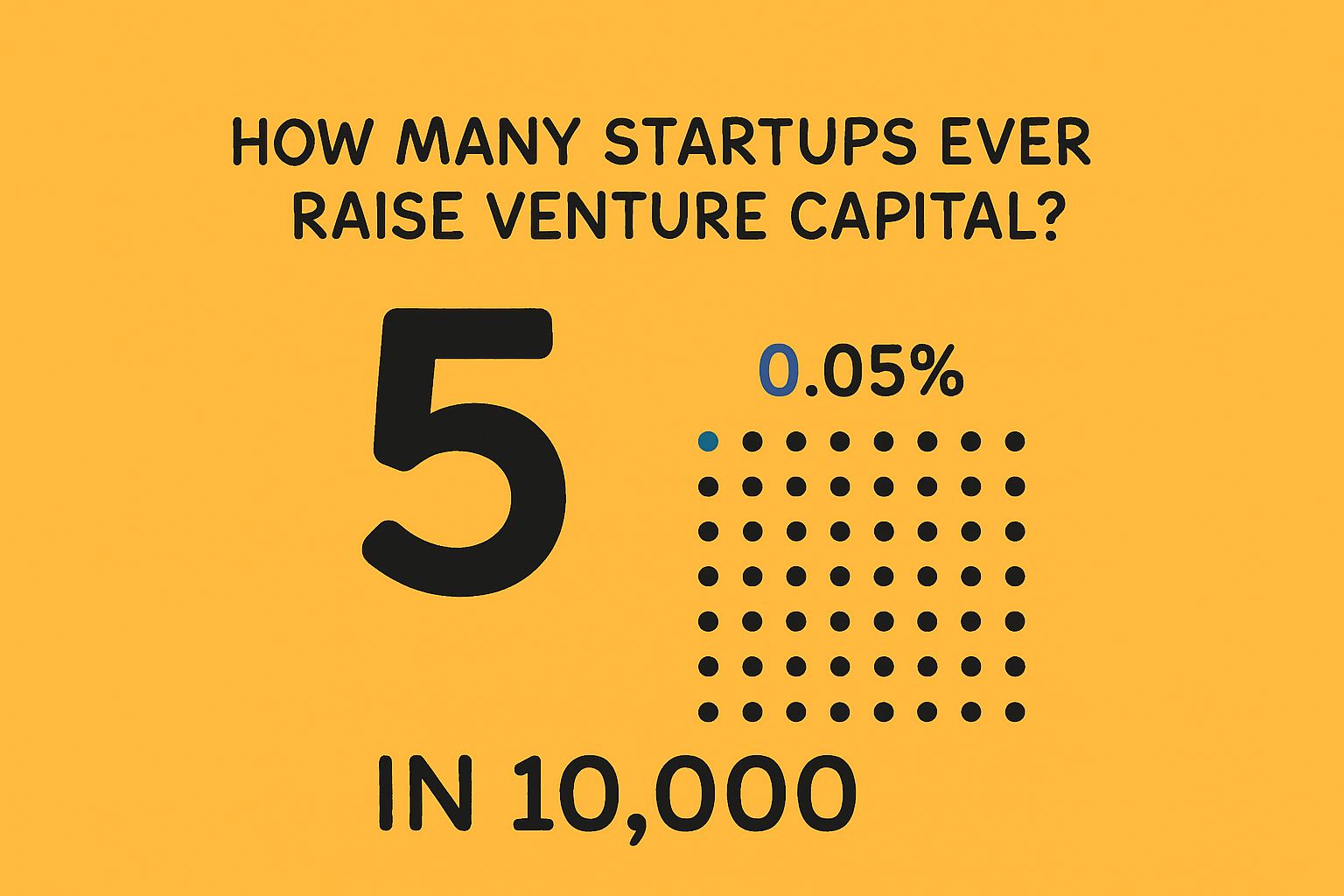

This Week's Number

0.05%1.

That's how many startups ever raise venture capital.

Not 5%. Not 0.5%.

0.05%

Five in 10,000.

But when you're scrolling Twitter or reading TechCrunch, it seems like everyone is raising millions. That's survivorship bias working exactly as designed.

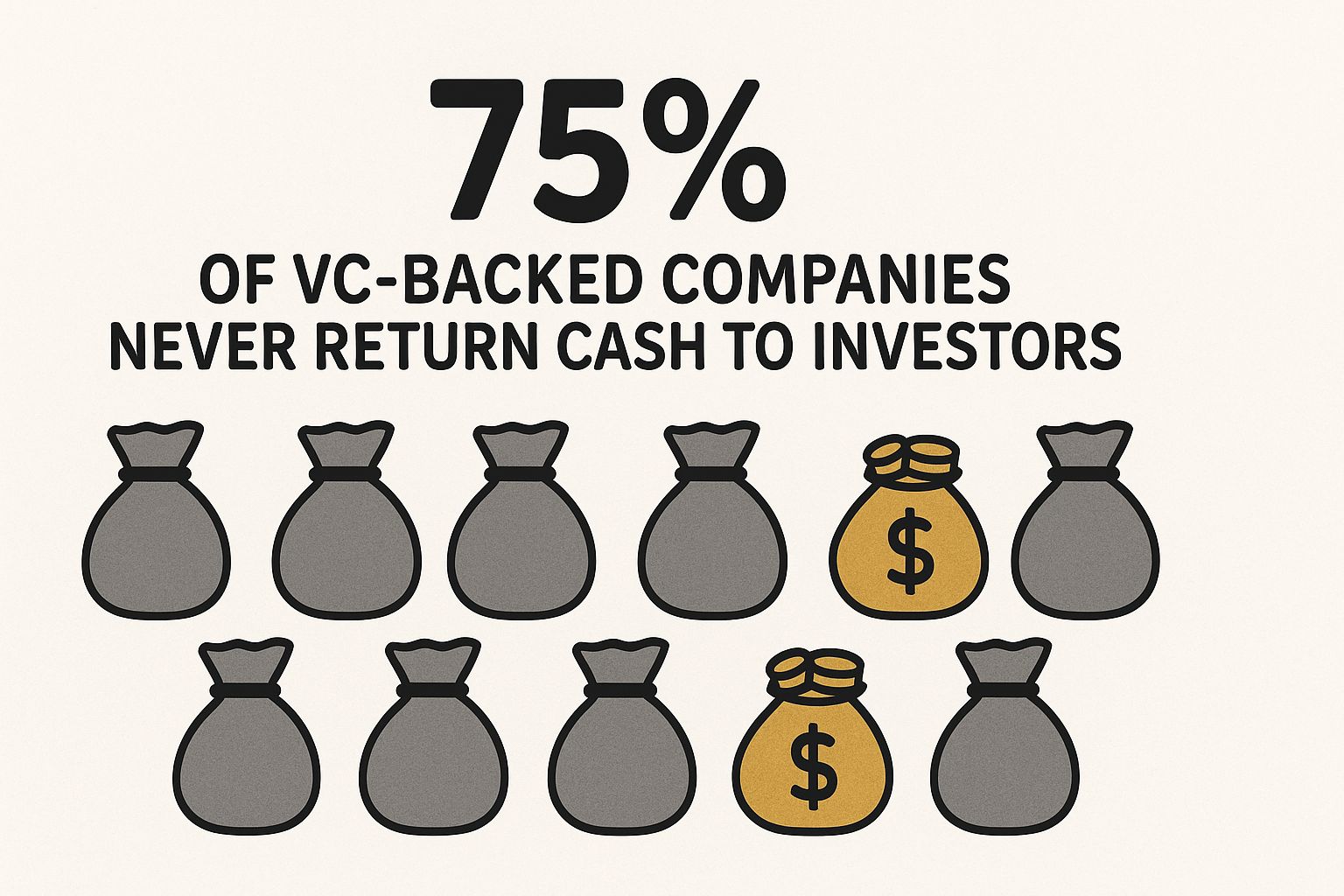

Here's the stat that made me write a 350-page book:

75% of the VC-backed companies in that lucky 0.05% never return cash to investors2.

You beat 9,995 founders to get funding. Then you still have a 75% chance of failing.

The odds are worse than a casino.

And yet every piece of startup advice assumes you'll raise VC. Because most of it was written by VCs for VCs.

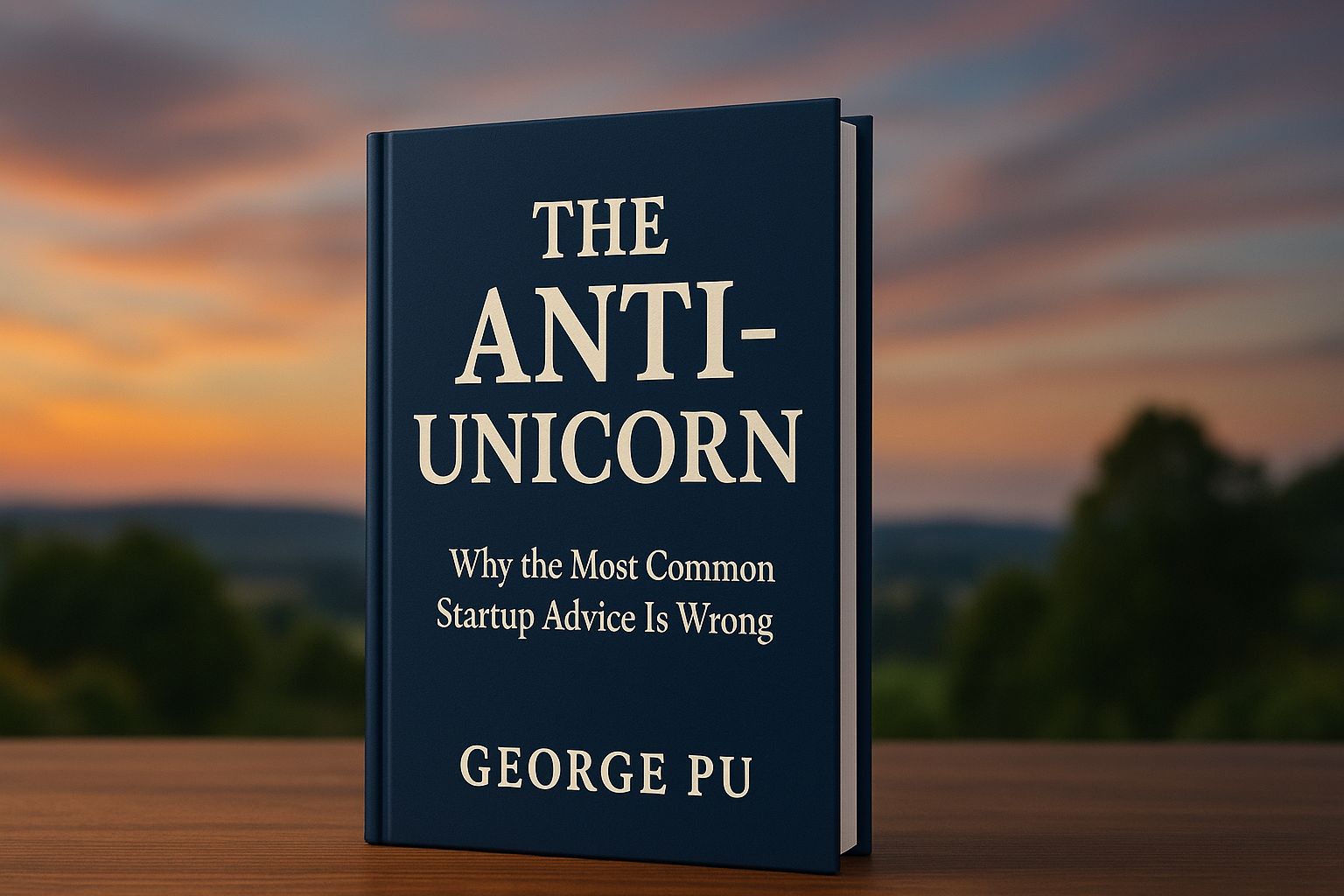

I just published The Anti-Unicorn: The Consulting Model to show you the path that actually works for the other 99.95%.

The Anti-Unicorn is my new free e-book for the community, in second draft and available

The Main Thing

What Peter Thiel Didn't Tell Me (And Probably Didn't Tell You)

When I was 19, sitting in a dorm room at University of Waterloo, I read Zero to One three times. Took notes. Highlighted passages.

It was my bible.

Peter Thiel—the billionaire who backed Facebook—wrote about building monopolies through scale and technology. The book is brilliant.

Image Credit: Story Shots

But here's what I missed: Thiel wrote that book for his deal flow.

He's a venture capitalist. His entire job is finding founders who will take his money, scale aggressively, and return 100x.

The book assumes you're:

In Silicon Valley

Already connected to VCs

Building something that can scale to billions

Comfortable burning millions to get there

That's great advice if you match that profile.

But if you're a 19-year-old immigrant in Waterloo, Ontario trying to figure out how to make rent? That advice isn't just useless. It's actively harmful.

Being in Waterloo, Ontario is quite different from living in the Silicon Valley

It'll make you feel like you're failing when you're actually just playing a game that was rigged against you from the start.

The Geography Lottery

Here's the math nobody told me:

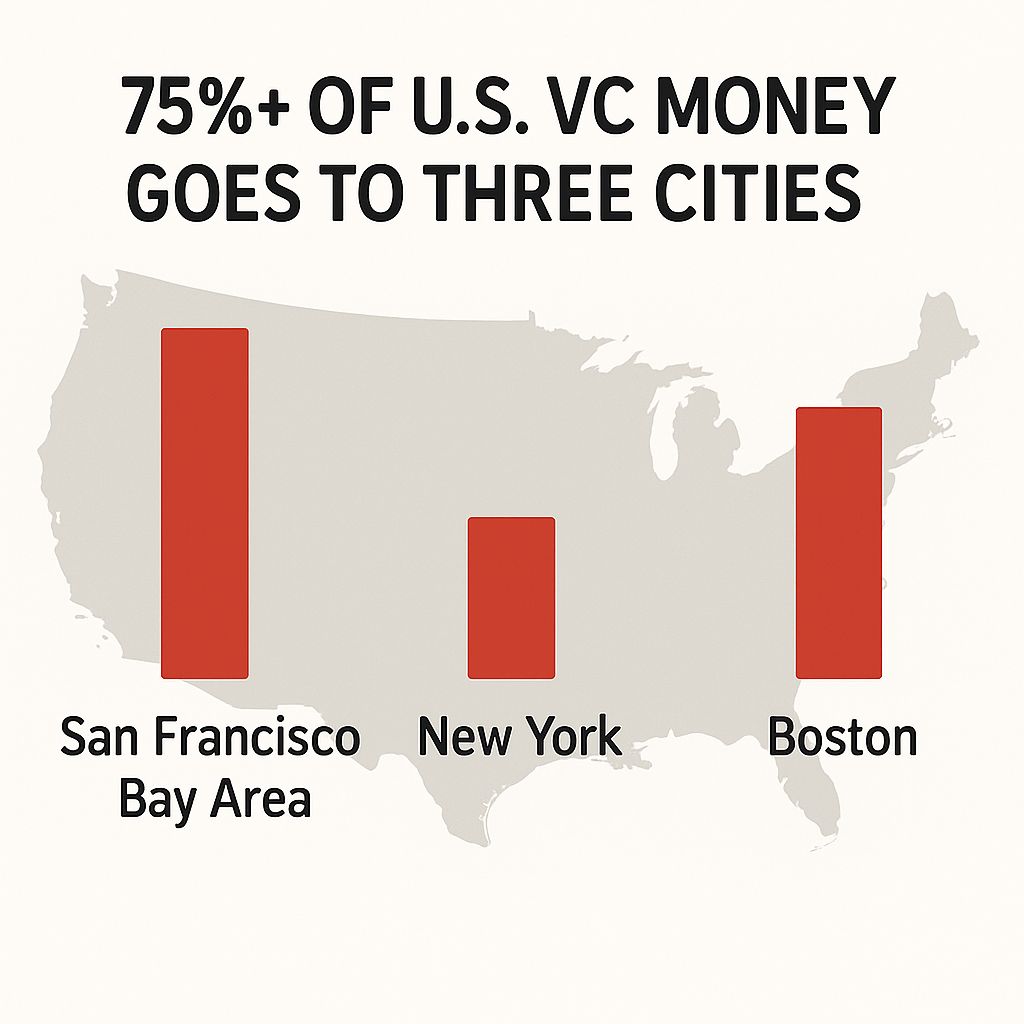

75%+ of US VC money goes to three cities3:

San Francisco Bay Area

New York

Boston

If you're not in one of those three, you're fighting for scraps.

Canada (where I'm from)? Only 2-3% of North American VC flows north of the border.

Waterloo? Not even on the map.

Your business could be incredible. Your team could be world-class. Your traction could be undeniable.

But if you're not in the right zip code, you're invisible.

What I Did Instead

After my $350K angel round fell through in 2021 (whole story in Chapter 1), I had a choice:

Keep chasing VC. Keep trying to prove I could raise. Keep optimizing for metrics investors wanted.

Or change the game entirely.

I chose option 2.

I stopped trying to build a product people might pay $29/month for someday.

I started consulting first—charging $5K-$50K upfront before writing a single line of product code.

Within 6 months: profitable.

Within 2 years: multiple six-figures in revenue.

Within 6 years: millions in actual cash (not paper valuations), zero VC funding.

SimpleDirect is still here. Year 6. Profitable. Growing. Mine.

Most of the VC-backed companies that launched when I did? Quietly gone.

What's Actually In The Book

Part 1: Awakening (Chapters 1-4)

This section will piss you off. That's the point.

You'll learn:

Why Zero to One, Hard Thing About Hard Things, and YC advice was written for someone else

The real VC math (spoiler: it's a power law lottery, not a business strategy)

Why building from "nowhere" (Toronto, Arkansas, Singapore) beats San Francisco

The revenue lie everyone tells you (build first, charge later = recipe for failure)

The Silicon Valley show was a great satire, loved the show, hated the culture

Part 2: The Alternative (Chapters 5-12)

This section shows you exactly what to do instead.

You'll get:

The consulting-first model (how to build leverage without VC)

Month-by-month methodology for your first 12 months

Cold outreach templates that actually work (real emails, real results)

Pricing frameworks (how to charge what you're worth)

The product transition (when consulting becomes software)

30-year mindset (compounding beats exits)

Redefining success (your metrics, not Paul Graham's)

Part 3: The Movement (Chapter 13)

Why I'm giving this away free and what happens when 10,000 founders choose this path.

Section 3: Who This Book Is For

You should read this if:

You're outside SF/NY/Boston (geographic disadvantage)

You're pre-revenue or under $50K MRR

You don't have VC connections

You want to own your company (not give away 60-80%)

You're tired of "just raise money" as the default answer

You want cash flow, not valuation screenshots

You can skip this if:

You're already VC-backed and committed to that path

You're building something that requires massive capital (hardware, biotech)

You're in SF with strong VC network and want to play that game

You don't mind giving up control and ownership for speed

This book isn't anti-VC. It's anti-"VC is the only path."

For 99.95% of founders, there's a better way.

Section 4: Why I'm Giving This Away

I could have sold this for $47. Or $197. Or launched a $2,000 course.

I'm not doing that.

Because the VC ecosystem has:

Billions in management fees

Media connections (every unicorn IPO = free PR)

University relationships (YC, Stanford, Harvard)

Network effects (portfolio companies refer to each other)

The bootstrap path? We've got nothing except the truth and real outcomes.

One founder bootstrapping successfully is an anomaly.

1,000 founders is a pattern.

10,000 founders is a movement.

Movements change what's possible.

This book is my bet on critical mass. If you read it, build profitably, and share your story—we change the default path for the next generation.

That's worth more than selling PDFs.

Section 5: How to Get Started

Step 2: Read Chapter 1 first

You'll see exactly why you've been following advice that wasn't written for you

Takes 15 minutes, will save you years

Step 3: Jump to what you need:

Pre-revenue? Chapter 7 (Finding Your First Customers)

Already consulting? Chapter 10 (Product Transition)

Considering VC? Chapter 2 (The VC Math)

Burned out? Chapter 12 (Redefining Success)

Step 4: Reply to this email Tell me:

What's the one piece of Silicon Valley advice you've been following that doesn't fit your situation?

I read every response. And your answer helps me know what to write about next.

Welcome to the 99.95%.

— George