Did you watch the Super Bowl this year?

If you did, you probably noticed something. Fifteen out of sixty-six commercials were AI companies. Twenty-three percent of all ad slots. Back to back to back.

Anthropic ran an ad that Sam Altman called "deceptive" within hours. OpenAI pushed Codex. Google had Gemini redecorating a house — Kellogg ranked it best ad of the night. Amazon, Meta, Microsoft all showed up. Some company called ai.com ran a cryptic AGI ad that got failing grades from every reviewer.

And then Svedka — a vodka brand — ran what it called the first "primarily AI-generated" Super Bowl commercial. A vodka company. Using AI as the selling point. For vodka.

Maybe you watched all that and thought nothing of it. Maybe you thought it was cool, or annoying, or just the way things are now.

I watched it and felt something I have felt exactly twice before.

We Have Seen This Before. We Just Have Short Memories.

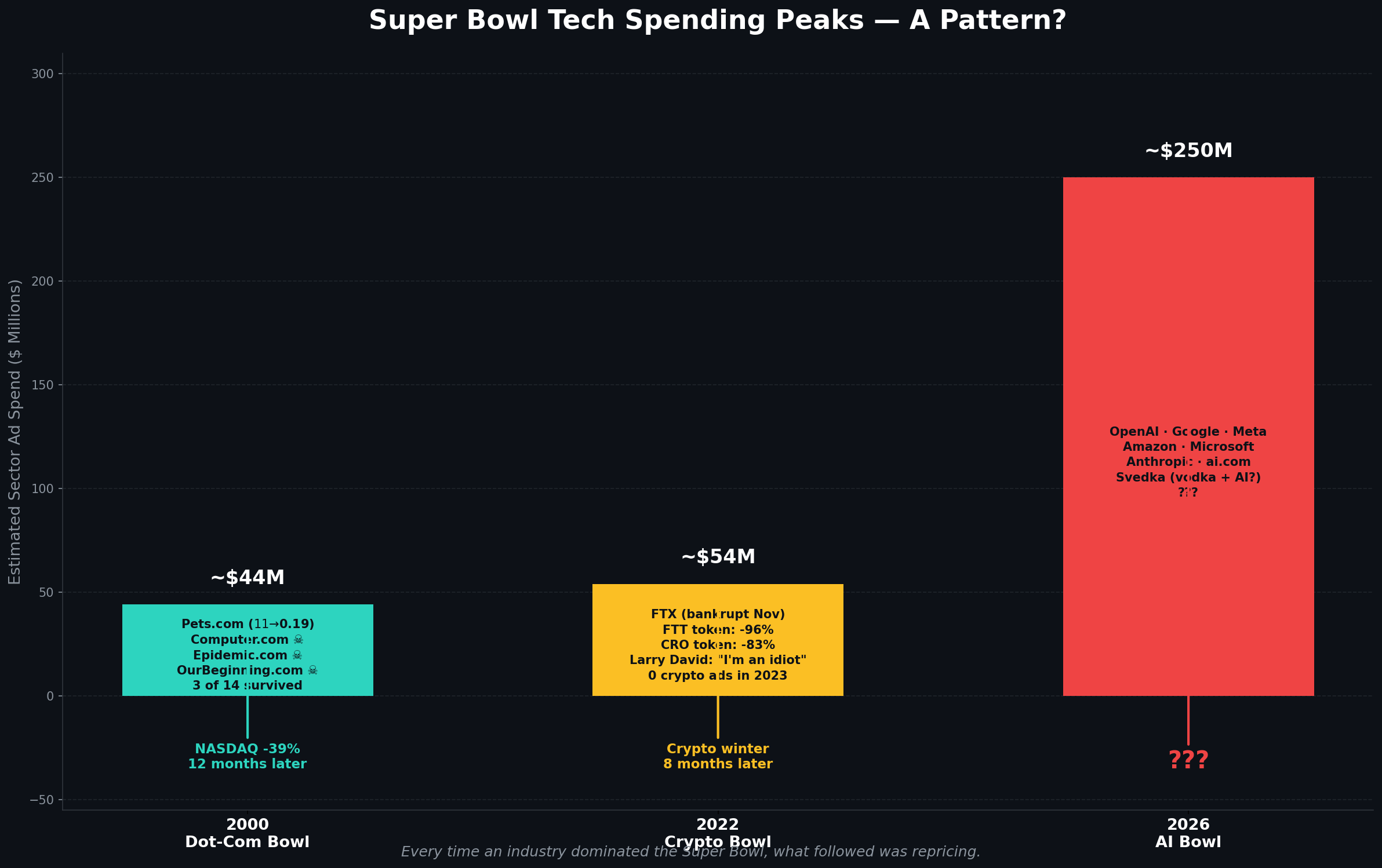

In January 2000, fourteen dot-com companies bought Super Bowl ads. $2.2 million each — $44 million total. Pets.com had a sock puppet on your TV. E-Trade had a dancing monkey. OurBeginning.com spent $5 million on ads and their customers spent one-tenth of that. Computer.com. LifeMinders.com. Names nobody remembers.

The NASDAQ peaked two months later. Pets.com went from IPO at $11 to liquidation at $0.19. Of the fourteen, only three still exist: Autotrader, Monster, and WebMD.

One year later, E-Trade's Super Bowl ad featured its chimpanzee walking through a ghost town of dead dot-com offices. The Pets.com sock puppet made a cameo, sitting in a dumpster. That was all that was left.

Then February 2022. The "Crypto Bowl." Four companies — FTX, Coinbase, Crypto.com, eToro — spent $54 million combined. FTX paid Larry David $10 million for thirty seconds. Crypto.com had Matt Damon telling America that "fortune favors the brave." Coinbase ran a floating QR code that crashed their app from the traffic.

FTX was bankrupt by November. Sam Bankman-Fried is in prison. The FTT token went from $44.87 on Super Bowl Sunday to losing 96% of its value. Crypto.com's CRO token dropped 83%. Larry David later called himself "an idiot" for doing the ad. By the 2023 Super Bowl, there were zero crypto ads. Zero.

We watched this happen. Twice. And here we are again.

Why the Super Bowl Is a Bubble Indicator

Now it is February 2026. Fifteen AI ads. An estimated $250 million in AI ad spending. Spots going for $8 to $10 million for thirty seconds.

OpenAI, Google, Amazon, Meta, Microsoft, Anthropic — the biggest companies on the planet, all needing your living room on the same Sunday.

The question is not "is AI real?" Of course it is. Anthropic has a $14 billion run-rate. OpenAI has reaccelerating user growth. These are real products with real enterprise adoption. The dot-com was real too. The internet was real. Amazon survived.

The question is: why does an industry with real products and real revenue need to spend $250 million in one night to advertise to a mass audience?

Think about what a Super Bowl ad actually is. It is the most expensive way to reach the broadest possible audience.

You do not buy a Super Bowl ad to reach your existing customers. You buy one when you need everyone — your grandmother, your barber, your Uber driver — to know your name.

You buy one when the capital is flowing so fast that $10 million for thirty seconds feels like a rounding error. You buy one when the story you are selling to investors requires mainstream awareness as proof of product-market fit.

That is not a sign of maturity. That is a sign of a cycle peaking.

Here is the part that does not get enough attention.

The Super Bowl happens in a country where rent is up 36% since 2020, groceries are up 26%, and ACA health premiums just jumped 26% this year.

The capital markets are living in a completely different world than the rest of us.

$250 million on Sunday ads while the people watching those ads are trying to figure out how to cover a grocery bill that has gone up by a quarter in five years. $130 billion deployed into AI in eight weeks while the median American has not seen a real wage increase that keeps pace with the cost of housing, food, or healthcare.

This is the disconnect that defines every bubble. Not that the technology is fake — it is not. But that the capital is moving at a speed and scale that has completely detached from the economic reality of the people it is supposed to serve.

That was true of dot-com in 2000. It was true of crypto in 2022. And it is worth asking whether it is true of AI in 2026.

I am not calling a crash. I am calling a disconnect. And disconnects do not resolve quietly.

$130 Billion in Eight Weeks

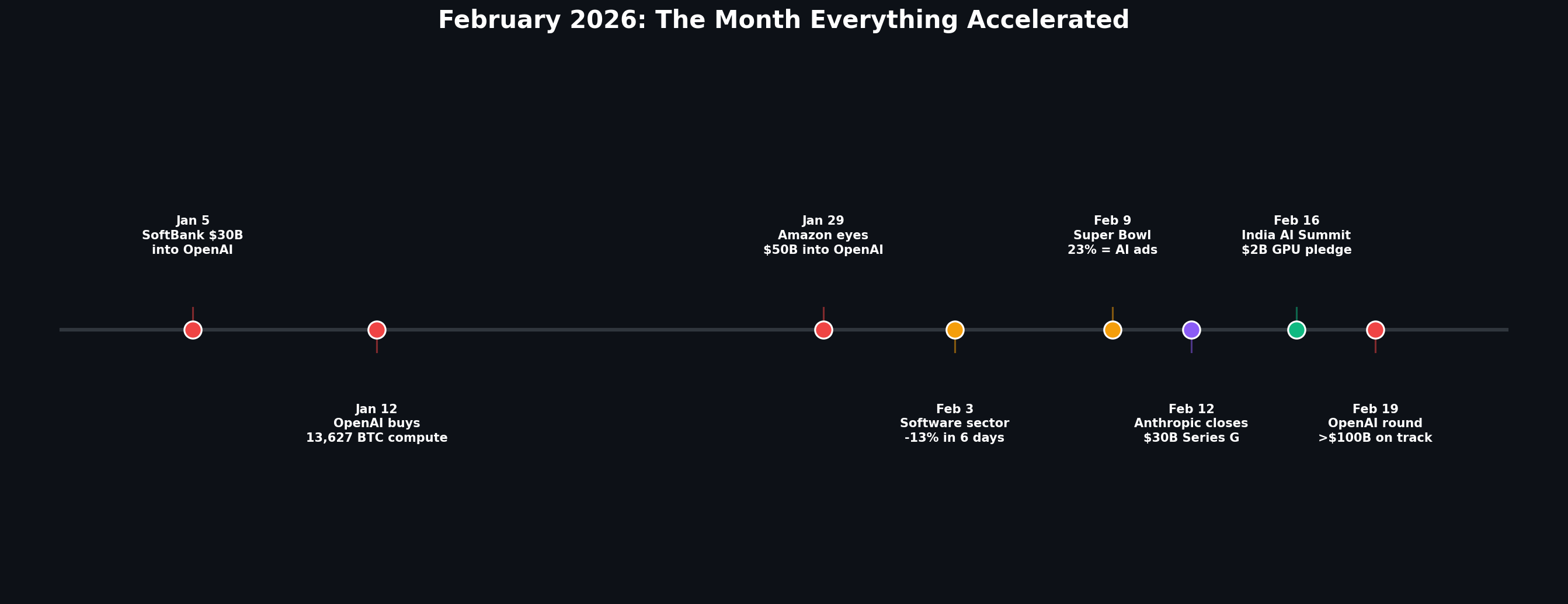

The sequence matters. Look at the chart.

SoftBank writes a $30 billion check to OpenAI on January 5. Amazon eyes a $50 billion position three weeks later — into a company that competes with its own AI platform. The software sector crashes 13% in six trading days in early February. Not AI companies. Software companies. The tools-for-humans companies.

Then Anthropic closes a $30 billion Series G at a $380 billion valuation. Eight of the Fortune 10 are active Claude customers. Claude Code alone has a $2.5 billion run-rate that doubled since January.

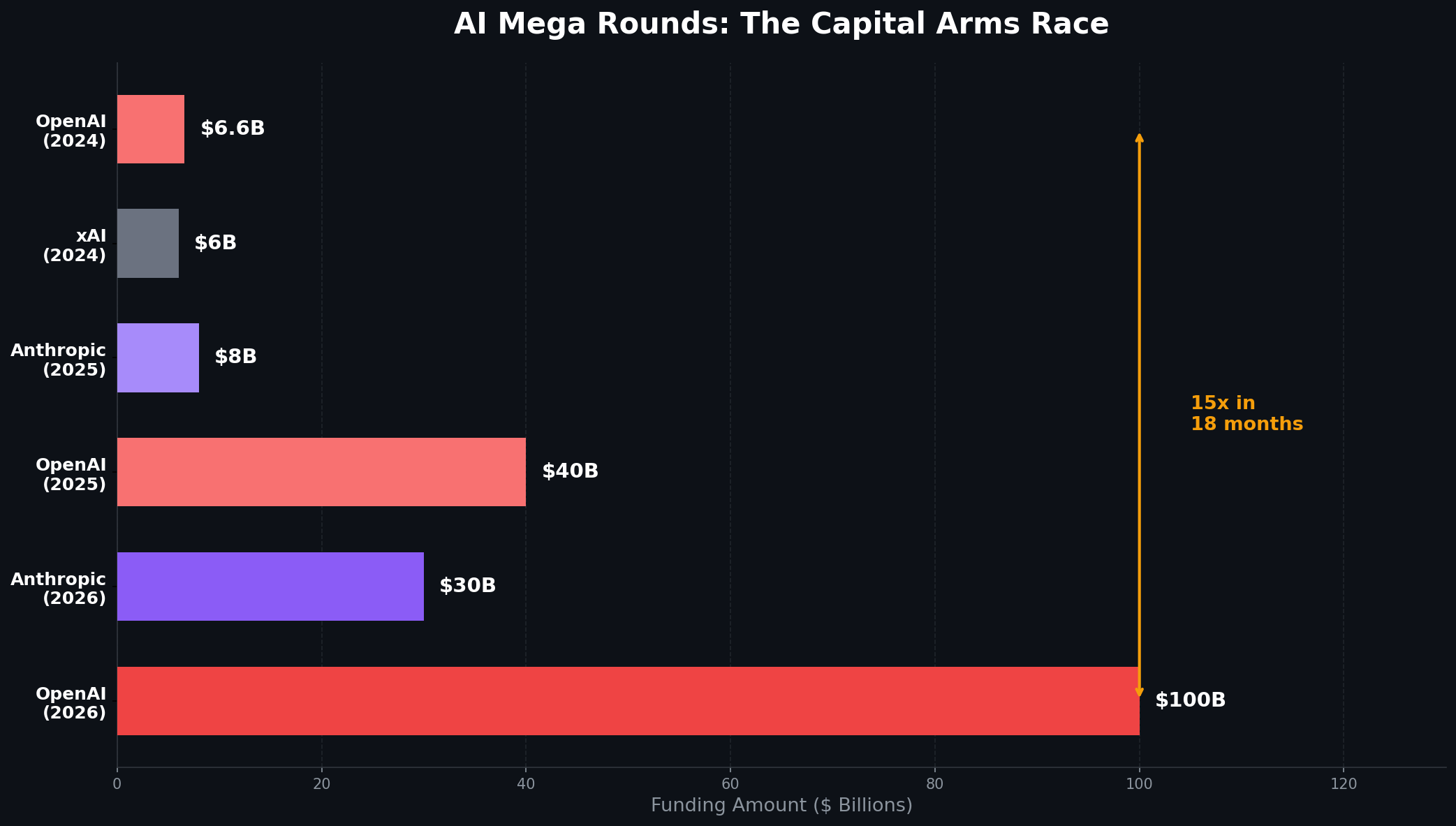

And today — February 19 — Bloomberg reports OpenAI's round is on track to exceed $100 billion. Valuation could surpass $850 billion. The investors: SoftBank, Microsoft, Nvidia, Amazon, Abu Dhabi sovereign wealth funds, Thrive Capital, Founders Fund, BlackRock.

That is $130+ billion deployed into AI in under two months. Not announced. Not projected. Deployed.

OpenAI's projected losses for 2026? $14 billion. Cumulative losses through 2029? $115 billion. Profitability expected "sometime in the 2030s."

Read that again. The most valuable private company in history expects to lose $115 billion before it makes money. And the smartest capital allocators on Earth are lining up to fund it.

Why?

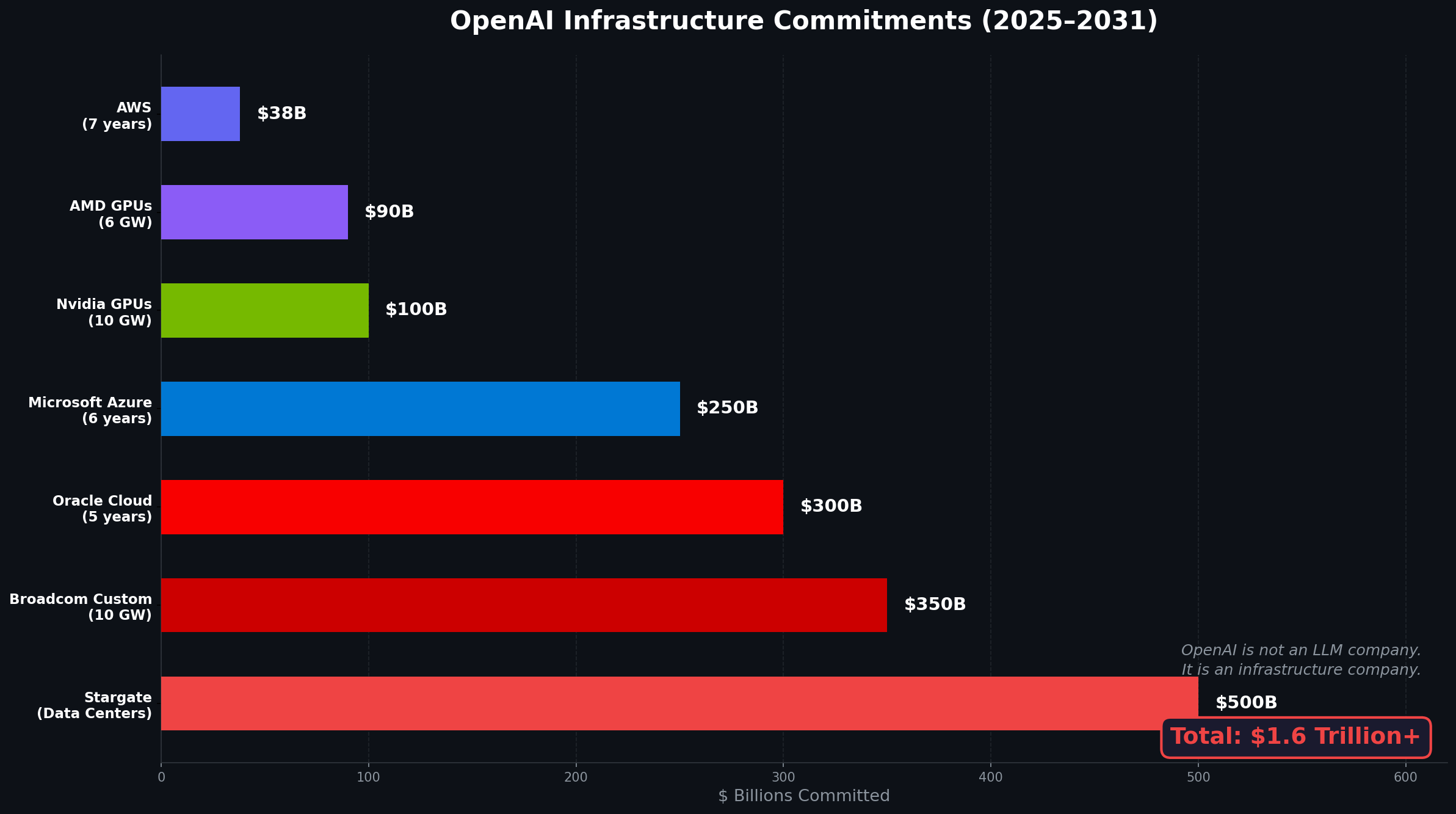

Because they are not buying an LLM company. They are buying an infrastructure company.

The Pivot Nobody Is Talking About

Here is the number that puts everything in perspective: OpenAI has signed over $1.4 trillion in infrastructure commitments in the last twelve months. Not billion. Trillion.

$500 billion for Stargate data centers across the US. $300 billion to Oracle. $250 billion to Microsoft Azure. $100 billion to Nvidia. $90 billion to AMD. $350 billion to Broadcom. $38 billion to AWS.

These are not software deals. These are power grid, chip supply chain, physical infrastructure deals. SoftBank is converting an Ohio EV plant into a data center factory. They have Stargate projects in the UAE, Norway, the UK, and Argentina.

This is not a company building a chatbot. This is a company building the physical infrastructure layer of the next economy.

OpenAI figured out what Amazon figured out twenty years ago: the real money is not in selling the product. It is in owning the infrastructure everyone else builds on.

And here is why that matters: the LLM itself is commoditizing.

Frontier model output cost $60 per million tokens when GPT-4 launched in late 2022. Today, GPT-5 Nano does it for $0.40. That is a 150x decline in three years.

Open-source models — DeepSeek, Llama, GLM-5 — now match GPT-5 on most benchmarks and cost nothing to run locally. The gap between proprietary and open-source is down to single digits on practical tasks.

Meta's strategy is explicit: flood the market with free models to commoditize the competition. Marc Andreessen has openly mused about whether this is a "race to the bottom."

So if the LLM is heading toward zero, why is $130 billion still flowing in?

Because the investors are not betting on the model. They are betting on the infrastructure. Whoever controls the data centers, the compute, the chip supply, the power — controls the rails.

Every open-source model, every startup, every enterprise deploying AI will need compute. And the compute lives in somebody's data center.

OpenAI is not competing with DeepSeek on model quality. OpenAI is competing with AWS, Azure, and Google Cloud on who owns the next generation of cloud infrastructure. The LLM is the trojan horse. The data center is the product.

That is what $130 billion is actually buying. Not a better chatbot. A toll booth on the future of computing.

Meanwhile, On the Other Side

I have written about layoffs before. You have read those numbers. I am not going to repeat them — 30,700 tech workers in seven weeks, 55,000 AI-attributed job losses in 2025, young worker employment down 13%. You know.

What I want to talk about this week is what happens to the people who still have jobs.

Because this is the part that does not make headlines. The squeeze is not just about who gets laid off. It is about what life costs for everyone else.

Rents are up 36% since 2020. Not in San Francisco. Nationwide. If you are a 25-year-old starting your career in 2026, you are paying a third more for housing than someone in the same job paid six years ago — and your starting salary has not moved a third.

Groceries are up 26.4%. Healthcare costs rising 6 to 7% — double the general inflation rate. ACA marketplace premiums up 26% this year. If you are self-employed or between jobs, you felt that one. Natural gas rising more than twice as fast as wages.

The CPI says inflation is 2.4%. That is technically accurate. It is also completely misleading if you are trying to pay rent, eat, and keep the lights on in a major city. The things you cannot opt out of — housing, food, healthcare, energy — are all rising faster than your paycheck.

Now put these two realities next to each other. On one side, $130 billion flows into companies building technology that replaces human workers.

On the other side, the humans who still have jobs are watching their purchasing power erode every month. The cost of existing keeps going up. The value of your labor keeps going down. The gap between these two lines is the story of 2026.

The India Signal

India's AI Impact Summit opened on February 16. Politicians gave speeches. $2 billion in GPU infrastructure was pledged. Headlines were written. Everyone moved on.

Meanwhile, at the same summit, Vinod Khosla said IT outsourcing could be "gone by 2030." Not shrinking. Gone.

And the market already agrees. On February 4, Indian IT stocks crashed 6% in a single day — not because of earnings, not because of a scandal — because Anthropic released Claude Cowork, an agentic tool designed to automate the exact kind of repetitive knowledge work that 5 million Indians do for a living.

TCS, Infosys, Wipro — the companies that built India's middle class — have already cut 80,000 jobs in the last 18 months. Median tech compensation in India has dropped 40% year-over-year. Clients are demanding 20% price cuts on outsourcing contracts.

The $300 billion Indian IT sector is repricing in real time.

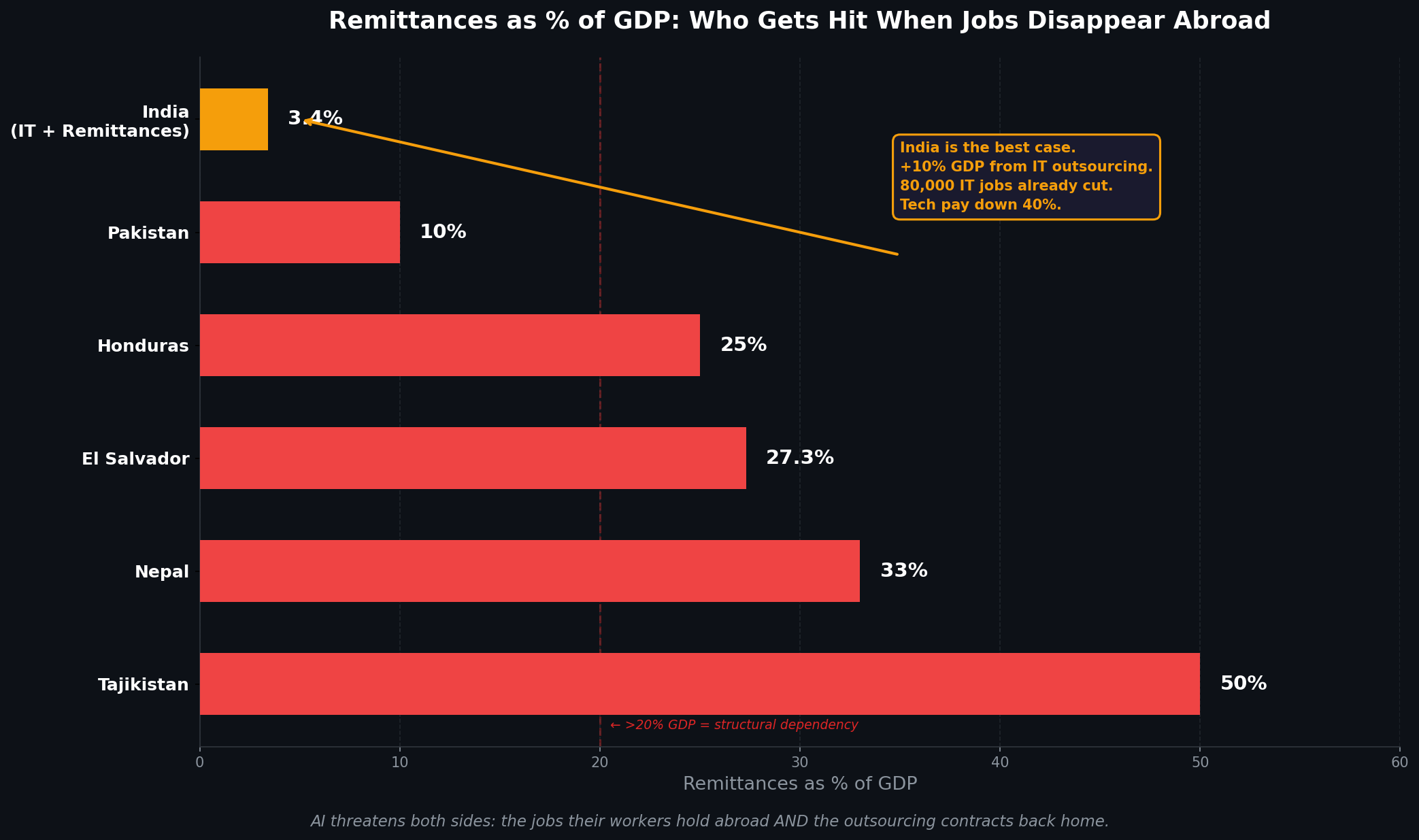

India's IT industry is 10% of the country's GDP. That is not a sector. That is a load-bearing wall.

And here is what makes this the real signal: India is the best-case scenario.

India at least has the IT infrastructure, the talent base, the IITs, a domestic market of 1.4 billion people. If any developing country can navigate this transition, it should be India.

Now look at the countries that cannot.

Pakistan: $34.9 billion in remittances last year, nearly 10% of GDP. No $300 billion IT sector to fall back on. When the knowledge-work jobs that Pakistani workers do in the Gulf and the US start getting automated, those flows do not get replaced by anything.

Honduras: 25% of GDP is remittances. Eighty-three percent of all export value. The US just passed a 1% tax on remittance transactions. Deportation enforcement at a multi-decade high.

El Salvador: 27.3% of GDP. $10 billion sent home in 2025 — their best year ever. Sounds like growth until you realize the entire model is built on people leaving.

Tajikistan: 50% of GDP. Nepal: 33%. They issued 500,000 foreign employment permits in a single year because there is nothing at home.

These countries built their economies on two things: their people leaving to do work elsewhere, and richer countries offshoring work to them. AI threatens both sides simultaneously.

The $2 billion GPU pledge at the India AI Summit is the same thing as a Canadian politician announcing a "reskilling initiative" or a US congressman holding a hearing on "AI and the future of work."

It’s all for show. It is what governments do when they do not have an answer. They hold a summit. They pledge some money. They say the word "innovation" enough times and hope nobody does the math.

$2 billion against a $130 billion arms race. That is not a strategy. That is a press release.

So What Do You Actually Do?

That is a lot of data. Here is what I am doing about it — and what I would tell anyone who just read all of the above.

1. Audit your job the way investors audit a company.

$130 billion is being deployed to automate human labor. Indian IT stocks crashed 6% because one agentic tool launched. 80,000 Indian tech workers — skilled ones — gone in eighteen months.

If you spend your day processing information, generating reports, writing routine code, or managing data — you are on the wrong side of the two AI worlds.

A company I know just cut their QA team from twelve to four. Claude turned out to be better and cheaper.

2. Build more than one income stream.

The winners are building toll booths, not products.

If 100% of your income comes from one employer, you have a single point of failure during the most disruptive economic transition in a generation.

I run three separate revenue lines right now. Not because I am ambitious (I’m not). Because I watched what happened to people who had one.

3. Start saving like rent is going up 36%.

Because it already did. Groceries up 26%. ACA premiums up 26%. The CPI says 2.4% but the things you cannot opt out of are running 10x that.

Eight months of expenses saved — not invested, saved, liquid — gives you the ability to make decisions from strength instead of desperation.

When my SaaS revenue collapsed in late 2025, my savings bought me time to pivot instead of panic.

4. Invest in assets, not Super Bowl ads.

You saw what happened to people who bought FTT at $44.87 on Crypto Bowl Sunday. Saylor's company Strategy holds 714,000 Bitcoin and is $6.5 billion underwater right now.

He can survive that. Can you? The people telling you what to buy are playing a different game than you. Different risk tolerance, different balance sheets, different incentives.

5. Take your health seriously.

When the world looks like everything above — trillion-dollar bets, cost of living squeezing from every direction, entire countries watching their economic models collapse — the people who make clear decisions are the ones who sleep, eat, and move.

I have watched friends take 40% pay cuts because they were too burned out to negotiate. Your body is infrastructure.

6. The LLM race to zero is your opportunity.

Frontier model costs went from $60 to $0.40 per million tokens in three years. Open-source models match GPT-5 on most benchmarks.

The tools OpenAI is spending $1.4 trillion to build infrastructure for — you can access for almost nothing.

In 2017, I fumbled through a PHP framework with Stack Overflow and panic. That became my first company. In 2026, you have Claude and Cursor. The only thing stopping you is starting.

7. Tune out the noise — especially the Super Bowl kind.

Fifteen AI ads. $250 million to make sure you saw them. Half the people talking about AI on social media are building audiences, not businesses.

The Saylor-style influencers telling you what to buy while $8.2 billion in convertible debt funds the position they are evangelizing. Self-dealing dressed as advice.

The signal is in what people do with their own money, not what they tell you to do with yours.

February 2026. $130 billion on one side. Rent up 36%. Groceries up 26%. Healthcare up 26%. Fifteen AI ads during the Super Bowl and the biggest private funding round in human history.

Same month.

We watched E-Trade's monkey walk through a ghost town of dead startups in 2001. We watched every crypto ad disappear by 2023. We watched both times and said "obviously, that was a bubble." And now we are watching fifteen AI ads in a country where people cannot afford groceries, and we are saying "this time is different."

Maybe it is. I do not know what the 2027 version of this story looks like. Nobody does. The people who tell you they know are selling something.

What I do know: the people who will be okay are the ones who stopped waiting for clarity and started building while everything was still unclear. The ones who own something — a business, a skill, a brand, a network — that AI cannot replace because it is fundamentally human.

You are the asset. Not your job. Not your employer. Not the tools you use. You.

Own or be owned. That has not changed. It just got more urgent.

— George

If this hit, forward it to someone who needs to hear it.

P.S. Some of my other writing this week on Founder Reality if you want to dig into it further: